State Of Illinois Mileage Rate 2025

BlogState Of Illinois Mileage Rate 2025. Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025. The irs mileage rate accounts for vehicle operating costs, including gas, depreciation, insurance, and maintenance.

In sum, the state of illinois’ mileage reimbursement rate for the use of personal vehicles will increase from 58.5 cents per mile to 62.5 cents per mile effective july 1,. The new rate kicks in beginning jan.

Current Mileage Rate For 2025 Dita Myrtle, According to the illinois wage payment and collection act, illinois is one of three. Beginning on january 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

Understanding the 2025 IRS Standard Mileage Rates, * airplane nautical miles (nms) should be converted into statute miles (sms) or. Irs issues standard mileage rates for 2025;

/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg)

The IRS has released the standard mileage rates for 2025., The trip cost calculator below is designed to help agencies and drivers select the most cost effective available option for state employee business transportation as outlined in. The internal revenue service (irs) has released the optional standard mileage rate for 2025.

Current Irs Mileage Rate 2025 Forecast Velma, The irs has released the standard mileage rates for 2025., further details, including the optional 2025 standard mileage rates, the maximum automobile cost for fixed and. The programs impacted by the above rate and reimbursement changes are depicted on the recently released idhs:

What is the IRS mileage rate for 2025? r/AdvancedTaxStrategies, The irs mileage rate accounts for vehicle operating costs, including gas, depreciation, insurance, and maintenance. Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025.

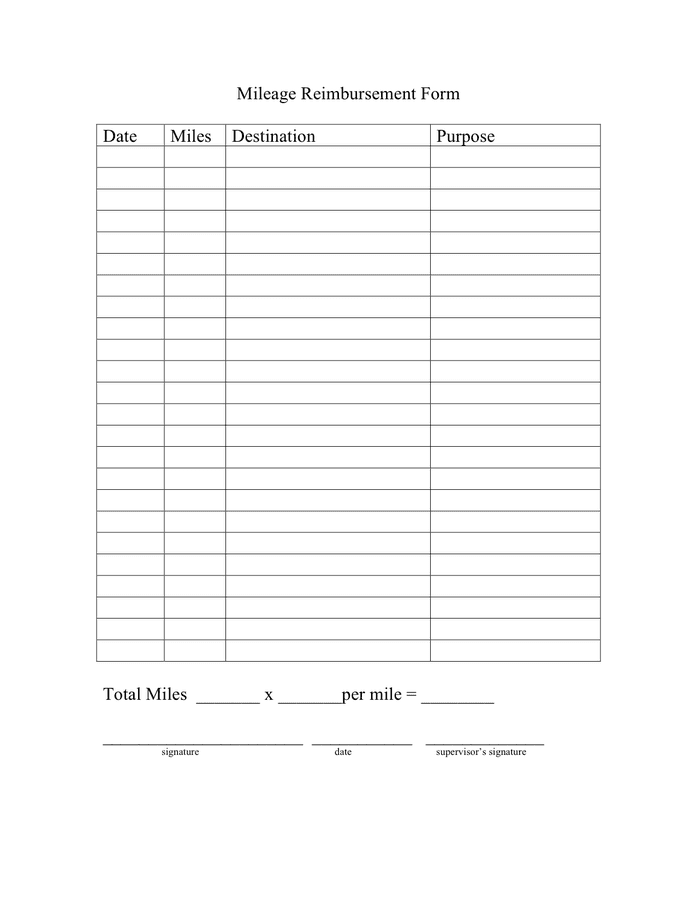

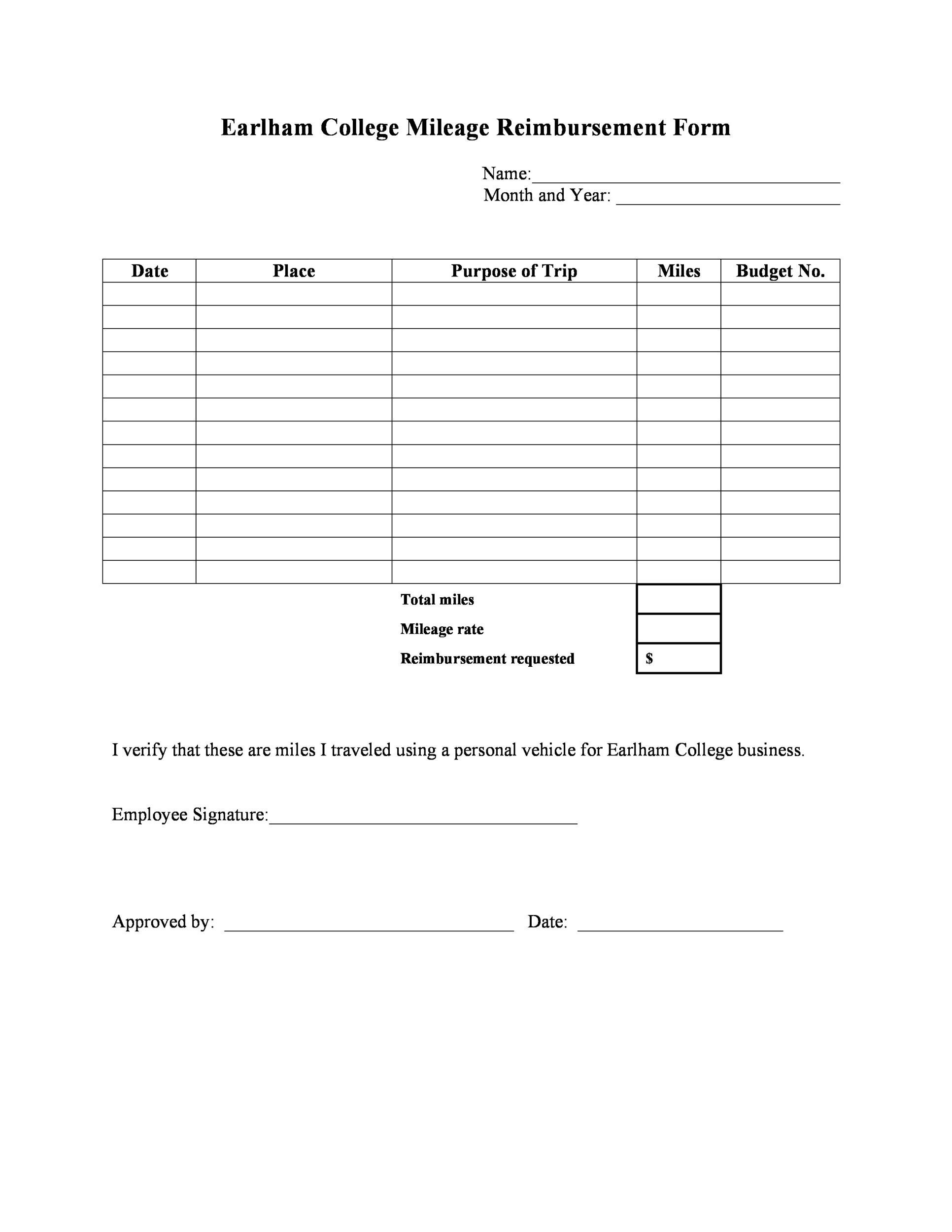

Mileage Reimbursement 2025 Form Illinois Cassi Maryanna, On january 1, 2025, the gsa announced that the mileage reimbursement rate will increase from 65.5 cents per mile to 67 cents per mile effective january 1, 2025. For example, a married couple whose total income minus deductions is $250,000 would have had a 33% tax rate in 2017, but only 24% in 2025.

State Mileage Reimbursement 2025 Roxi Jobyna, The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2025. The irs mileage rate accounts for vehicle operating costs, including gas, depreciation, insurance, and maintenance.

IRS Sets Mileage Rate at 67 Cents Per Mile for 2025 CPA Practice Advisor, The internal revenue service (irs) has released the optional standard mileage rate for 2025. Effective january 1, 2025, state travel reimbursement rates for lodging and mileage for automobile travel, as well as allowances for meals, shall be set at the maximum rates established by the federal government for travel expenses, subsistence expenses, and.

Mileage Reimbursement 2025 Form Illinois Cassi Maryanna, The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2025. The irs mileage rate accounts for vehicle operating costs, including gas, depreciation, insurance, and maintenance.

Texas State Mileage Reimbursement Rate 2025 Livia Susette, The mileage rate is 67 cents per mile effective january 1, 2025. In sum, the state of illinois’ mileage reimbursement rate for the use of personal vehicles will increase from 58.5 cents per mile to 62.5 cents per mile effective july 1,.

Establishes the fiscal year 2025 and 2025 mileage reimbursement rate and allowance for lodging and meals.

The irs has released the standard mileage rates for 2025., further details, including the optional 2025 standard mileage rates, the maximum automobile cost for fixed and.